Business Integration

Introduction

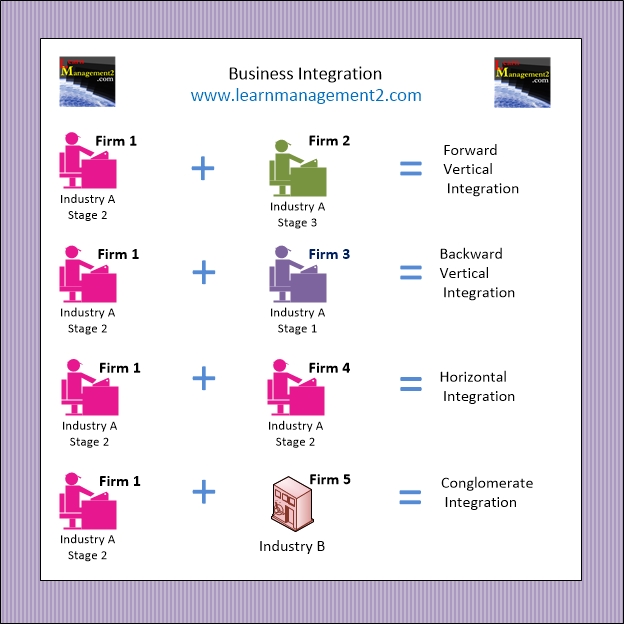

If a business needs to expand quickly they may decide to adopt one or more of the following integration methods: Vertical Integration, Horizontal Integration, or Conglomerate Integration.

This diagram explains the different types of integration that a business could undertake including vertical integration, horizontal integration, conglomerate integration and diversification.

Vertical Integration

Vertical integration takes place when a business decides to buy another business that operates in the same industry as them but is at a different stage of the production process.

- Forward Vertical Integration

- Backward Vertical Integration

Forward vertical integration means either taking over or merging with a business that you trade with. Let's imagine Learn Management PLC produces management books and articles and sells these to a large bookshop chain. If Learn management PLC may decide to buy or merge with the bookshop chain this would be called forward vertical integration. Forward vertical integration guarantees future business with the company that the integration takes place with. Forward vertical integration ensures that there is a guaranteed place for the product to go i.e. the next stage of the production process.

Backward vertical integration involves taking over or merging with a supplier. Using the fictional example above, if Learn Management PLC took over their fictional paper supplier “Paper r us & just 4u” this would be an example of backward vertical integration. This way Learn management ensure that they have paper supplied to them in a way that suits them. Backward vertical integration can reduce costs as a business will receive the product (which in our example is paper) at cost price and not have to pay money towards a supplier's profits.