Dividend Yield

Firms don't always distribute all of the profit it makes to shareholders, they will keep money back for future investments and emergency reserves. This means that even if the earnings per share seems to be a reasonable amount, it doesn't’mean that the shareholders have made a good return on their investment. Instead you need to calculate the dividend yield if you would like an indication of how well the return on shares compares to the price of a share.

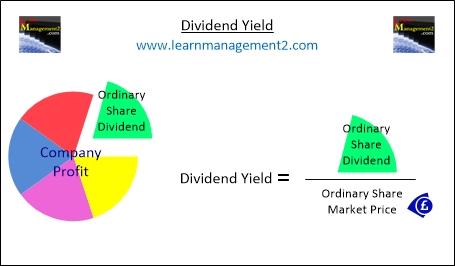

The diagram above shows how to calculate the dividend yield, using:

1)The ordinary share dividend amount and 2) The market price of an ordinary share

What Is The Dividend Yield?

The dividend yield compares the amount of money ordinary share shareholders receive in the form of dividends, against the market price of an ordinary share. The dividend yield is a useful calculation for shareholders to analyse the return they are receiving from their investments.

How Does the Dividend Yield Differ From Earnings Per Share/Earnings Ratio?

Dividend yield is different to earnings per share and earnings ratio because it takes dividends (the profit that the business has given to shareholders) into account. Dividend yield compares the market price of the share against the dividend paid out by the business.

Calculating Dividend Yield

To calculate the dividend yield you will need to find out the value of the ordinary share dividend and the ordinary share market price. Once you have these figures divide the ordinary share dividend by the ordinary share market price and multiply the answer by 100%.