Management Buyout

When employees decide to buy the business they are working for it is known as management buyout. Management buyouts are not restricted to managers and can involve employees at all levels in the organisation. This could be employees who want to share in the success of the business or others who feel that they could manage the business better than the present owners.

Management Buyout Reasons

There are many reasons why the management team may decide to buy the business they are working for including:

- The management team are unhappy with the decisions made by the owners, CEO or board of executives

- The business is in trouble/undergoing administration proceedings and employees feel that they can buy the business at a good price and make a success of it.

- The owners of the business decide to sell it and ask employees if they want to buy the business. For example the owners of a family run business want to retire or a group of companies decide that the business is no longer a key part of their current/future business strategy

- The management team do not want the business to be bought by someone else especially if this will involve the new buyers bringing their own employees or management team in.

Management Buyout Process

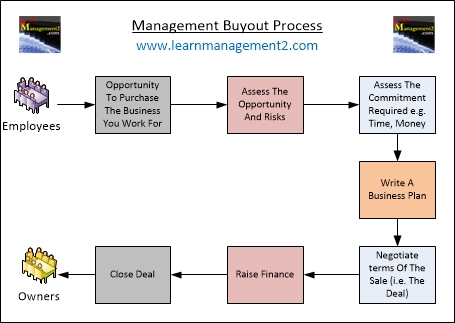

The diagram above outlines the management buyout process, when there's an opportunity to purchase a business and there is a set of employees interested in buying the business they will probably undergo a process similar to the one outlined below:

- The first step should be to assess the opportunity so that you balance the potential rewards against the risks which may hinder success such as changes in the industry/market, the competition and legal regulation. Find out why the owners are selling the business and carry out assessments such as a SWOT analysis

- Once you have established that the potential rewards outweigh the potential risks you will then need to decide whether you are prepared for the commitment; as an owner you will need to commit time, money and other resources

- Now that you have decided that you are willing to commit yourself to the business, you will need to write a business plan so that you can plan how to grow the business and you may need a business to secure finance and business partners.

- Once you know the businesses strengths, weaknesses and the risks you will be taking on, use this knowledge to assess how much you think the business is worth. Compare the business against the market value of similar businesses, it may be prudent to seek professional advice to help you decide the terms of the sale and a fair market price for the business. Armed with all of this information, go and negotiate the "deal" with the seller.

- Now that you know how much you will be paying for the business it is time to raise the finance. Possible sources of finance include personal savings, bank loans, loans secured against personal assets or money raised through sales of personal assets

- Final step - you have the money, you've negotiated the sale contract; time to go and sign the contract and close the deal!

Well Done you are now a business owner